Inflation is a long-term increase in the general price of an economy’s goods and services. When the overall price level rises, each currency unit loses purchasing power, decreasing the standard of living for consumers. Inflation has a significant impact on the global economy, as it can lead to higher production costs, increased unemployment, and reduced consumer spending.

The year 2023 has witnessed a surge in inflation rates in various countries, resulting in a challenging environment for businesses across the globe. Many businesses have yet to cope with the rising production costs and their consumers’ reduced purchasing power. Retailers, in particular, have been heavily affected, as they face the dual challenge of increased operating costs and diminished consumer demand. Other sectors, including manufacturing and hospitality, have also seen many businesses struggling to stay afloat amidst the rising tide of inflation.

For global businesses to survive and thrive in this era of high inflation, it is crucial to understand the impact of inflation on their operations and to develop effective strategies for adapting to the changing economic landscape. This article will discuss the consequences of store closures in 2023 and explore strategies businesses can adopt to adapt to the inflationary environment.

Effects of Inflation on Global Businesses

Inflation impacts businesses’ bottom line and has far-reaching consequences for the economy’s health. The following are the multifaceted effects of inflation on global businesses and how they contribute to the changing landscape that companies must navigate in an inflationary environment.

1. Increased Production Costs

Increasing production costs is one of the most immediate effects of inflation on global businesses. As raw materials, labor, and other input costs rise, businesses face mounting expenses in maintaining their operations. It can result in reduced profit margins and force companies to make tough decisions, such as downsizing, raising prices, or even closing their doors.

2. Reduced Consumer Spending

Inflation erodes the purchasing power of consumers, leading to a decline in overall consumer spending. As prices rise, consumers may be more cautious with their spending habits, opting to save money or prioritize essential goods and services over discretionary purchases. This decrease in demand can cause sales to slump, further straining businesses already grappling with increased operating costs.

3. Unemployment and Wage Pressure

Inflation can lead to higher levels of unemployment, as businesses may need to cut back on their workforce to counterbalance rising costs. It can create a negative feedback loop, as reduced consumer spending and increased unemployment further depress demand for goods and services. Additionally, workers may demand higher wages to keep up with the rising cost of living, increasing pressure on businesses to manage their labor costs.

4. Uncertainty and Reduced Investment

Inflation introduces uncertainty into the market, making it difficult for businesses to plan for the future. This uncertainty can deter businesses from making long-term investments or expanding their operations. Furthermore, inflation can negatively impact credit markets, making it more challenging for businesses to secure loans or access capital to fund growth initiatives.

5. Currency Fluctuations and International Trade

Inflation can also affect exchange rates, as currencies with higher inflation tend to weaken against those with lower rates. It can lead to currency fluctuations, which can impact international trade and the competitiveness of exports. Inflation-driven exchange rate volatility can create additional challenges in managing costs and revenues for businesses operating in multiple countries or those reliant on international trade.

6. Bankruptcies and Store Closures

As a culmination of these effects, inflation can lead to a rise in bankruptcies and store closures. Businesses that cannot adapt to the changing economic environment may need help to stay afloat, leading to closures, layoffs, and lost market share. It has a ripple effect on the broader economy, as it can lead to decreased tax revenue, reduced consumer confidence, and further economic stagnation.

Major Store Closures in 2023

The list of store closures in 2023 demonstrates the widespread impact of inflation on the retail sector. From well-established giants to smaller specialty retailers, businesses across the industry have been grappling with the harsh economic realities that have forced them to make difficult decisions about their future. These closures affect the affected companies, their employees, suppliers, and the communities they serve.

According to a Business Insider article, the primary reasons for store closures in 2023 include increased operating costs due to inflation, reduced consumer spending, and growing competition from online retailers. Additionally, the ongoing effects of the COVID-19 pandemic and supply chain disruptions have compounded these challenges, forcing many retailers to reevaluate their brick-and-mortar operations in favor of a more streamlined, digital-first approach.

Some notable examples of store closures in 2023, as reported by Business Insider, include:

1. Foot Locker

The athletic footwear and apparel retailer announced plans to close 545 stores, citing the need to optimize its store portfolio and focus on digital growth.

2. Walgreens

The pharmacy chain revealed plans to shutter 200 locations in the United States as part of a broader effort to reduce costs and streamline operations.

3. Bed Bath & Beyond

The home goods retailer closed 37 stores across the United States and Canada to optimize its real estate portfolio and invest in digital growth.

4. Gap and Banana Republic

The apparel giant planned to close 350 stores globally as it focuses on expanding its online presence and improving profitability.

5. JCPenney

After emerging from bankruptcy, the department store chain continued to face challenges, leading to the closure of an additional 15 stores in 2023.

6. Target

As part of its ongoing effort to optimize its real estate portfolio and focus on digital growth, the retail giant announced plans to close four stores.

7. Amazon

The e-commerce behemoth planned to close at least eight physical stores, citing the need to evaluate and streamline its brick-and-mortar presence.

8. Best Buy

The electronics retailer revealed plans to shutter 20 stores to optimize its physical footprint and continue expanding its e-commerce capabilities.

9. Bath & Body Works

The personal care and home fragrance retailer announced plans to close 50 stores as it focuses on optimizing its store locations and enhancing its online presence.

10. Walmart

The retail juggernaut disclosed plans to close 22 locations to streamline operations and prioritize digital growth.

These store closures represent just a fraction of the businesses affected by the economic pressures of inflation and the changing retail landscape. As the industry evolves, businesses must adapt to remain competitive and find new ways to thrive in a challenging environment.

Tips on Saving Money and Being Inflation-Ready

As consumers and businesses face the challenges of an inflationary environment, it is crucial to develop strategies to minimize the impact of rising prices on personal finances and maintain financial stability. Preparing for inflation involves adjusting one’s spending habits and making informed decisions about savings, investments, and financial planning.

Here are some tips on saving money and being inflation-ready, guiding how to navigate these turbulent economic times and maximize your financial resources.

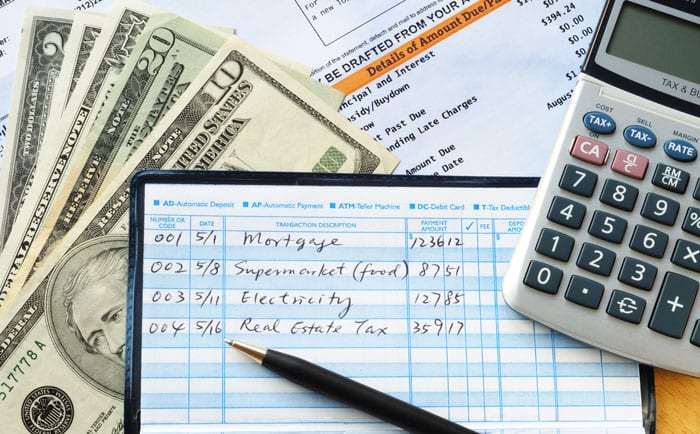

1. Create A Budget and Track Expenses

Developing a comprehensive budget that accounts for fixed and variable expenses is a crucial first step in managing your finances during inflationary times. You can better control your expenses and mitigate the effects of rising prices by tracking your spending and identifying areas where you can cut costs or adjust your spending habits.

2. Prioritize Essential Expenses and Reduce Discretionary Spending

In an inflationary environment, it’s important to prioritize essential expenses such as housing bills, food, and healthcare. Focus on reducing discretionary spending by reducing non-essential purchases and finding cost-effective entertainment, dining, and travel alternatives.

3. Build An Emergency Fund

Having a financial safety net in the form of an emergency fund can provide peace of mind and financial security during uncertain times. Aim to save at least three to six months’ living expenses in an easily accessible, low-risk account.

4. Shop Smart and Take Advantage of Discounts

Look for sales, discounts, and coupons when shopping for groceries, clothing, and other everyday items. These offers allow you to save money further and stretch your budget, even as prices rise.

5. Pay Off High-Interest Debt

Inflation can make it more difficult to pay off high-interest debt, as the cost of living increases may strain your budget. Focus on paying off high-interest debts, such as credit card balances, as soon as possible to reduce interest payments and improve your overall financial health.

6. Diversify Investments and Consider Inflation-Protected Assets

Since inflation can erode the value of your investments over time, it is critical to diversify your portfolio and consider investing in assets that may provide an inflation hedge. These can include inflation-protected securities, real estate, and commodities like gold.

7. Increase Your Income and Invest In Your Skills

Another way to offset the impact of inflation is to increase your income, either by pursuing a promotion, seeking a higher-paying job, or exploring side hustles. Investing in your skills and education can improve your long-term earning potential and career prospects.

8. Adjust Your Financial Goals and Expectations

Finally, it’s essential to recognize that inflation may impact your long-term financial goals, such as retirement savings or homeownership. Be prepared to adjust your expectations, reevaluate your goals, and develop new strategies to achieve financial success during inflationary times.

Staying Informed for Financial Preparedness

Inflation can have far-reaching consequences on the global economy, including increased production costs, reduced consumer spending, unemployment, market uncertainty, currency fluctuations, and bankruptcies. Adapting to inflation is crucial for businesses and individuals to maintain financial stability in challenging economic conditions. Staying current on economic trends and developments can help you make informed decisions and stay ahead of the impact of inflation.

Fortunately, many resources are available to help individuals and businesses prepare for inflation and manage their finances effectively. Using the tips and strategies in this article, you can maintain your financial preparedness and self-assurance in the face of inflationary pressures.