In the ever-evolving digital landscape of our time, a buzzword that has continually gained traction is cryptocurrency. This virtual or digital currency employs cryptography for security, making it extremely hard to counterfeit. However, with the rise of this novel form of an asset comes the proliferation of an unfortunate counterpart – cryptocurrency scams. The significance of discussing this topic, especially in 2023, cannot be overstated.

Cryptocurrency scams have become a pressing issue in this modern age, posing severe threats to the burgeoning digital economy and the individual investor. The ease of setting up online platforms and the anonymity provided by blockchain technology have emboldened scammers, making it all the more important for stakeholders to arm themselves with the knowledge necessary to combat these nefarious acts.

Stay tuned as we unmask the various aspects of cryptocurrency scams, their implications, and how you, as a savvy digital citizen, can protect yourself against these cyber threats. After all, the safety of your digital assets is paramount in this increasingly digitalized world.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that utilizes cryptographic technology to secure and verify transactions. Unlike traditional fiat currencies issued by the government, cryptocurrencies operate on decentralized networks, typically based on blockchain technology. This decentralized nature eliminates the need for intermediaries, such as banks, and allows for peer-to-peer transactions with high security and transparency.

Cryptocurrencies have exploded in popularity over the last decade, primarily due to their potential for high returns. Notable instances like Bitcoin’s meteoric rise have made it an enticing asset class, encouraging many to dip their toes into the digital currency. This volatile digital asset tends to attract those with a risk-on investment approach, willing to weather the storms of drastic price swings in hopes of potentially outsized gains.

Pros and Cons of Cryptocurrency

In finance, every investment carries a unique set of benefits and drawbacks. Cryptocurrency, with its novel features and unregulated nature, is no exception. Its unique structure and operation can give rise to a broader spectrum of pros and cons. Let’s dive into a balanced discussion about these advantages and disadvantages, which can, unfortunately, lay the groundwork for the proliferation of cryptocurrency scams.

Pros:

Cryptocurrencies have captivated the attention of individuals worldwide, attracting both seasoned investors and newcomers to the digital asset landscape. The allure of cryptocurrencies lies in several factors:

- Decentralization

Cryptocurrencies operate on a decentralized network based on blockchain technology, a distributed ledger enforced by a disparate network of computers. This decentralization provides a level of security and reduces the need for intermediaries.

- Potential for High Returns

The volatility of cryptocurrencies may mean the potential for significant returns for investors willing to withstand the risks.

- Anonymity and Privacy

Cryptocurrencies offer more privacy than traditional banking and transaction forms, attracting individuals valuing high confidentiality.

- Accessibility

Cryptocurrencies can offer an inclusive financial system, as anyone with an internet connection can make transactions without needing a traditional bank account.

- Inflation Resistance

Unlike traditional fiat currencies, most cryptocurrencies have a fixed supply. For instance, the total number of Bitcoins that can ever exist is capped at 21 million. This feature can potentially make cryptocurrencies resistant to inflation, which is particularly appealing in economically unstable times.

- Cross-border Transactions

With cryptocurrencies, transactions can be sent or received anywhere globally, typically with low fees and no need for currency conversion. It makes them particularly advantageous for international trade and remittances.

Cons:

Cryptocurrencies, despite their many advantages, are not without their drawbacks. Considering the cons associated with cryptocurrencies is important to comprehensively understand their potential risks and challenges.

- Price Volatility

The value of cryptocurrencies is highly volatile. This volatility can lead to substantial losses for investors.

- Lack of Regulatory Oversight

The absence of a governing body or regulation increases the risk of fraudulent activities and cryptocurrency scams.

- Potential for Misuse

The features that make cryptocurrencies attractive, such as anonymity, also make them appealing for illegal activities.

- Environmental Impact

Mining cryptocurrencies requires substantial computational power and electricity, leading to environmental concerns.

- Difficulty in Understanding

The technical nature of cryptocurrencies, blockchain, and related technologies can be challenging to comprehend for most individuals. This knowledge gap can lead to poor decision-making and susceptibility to cryptocurrency scams.

- Lack of Consumer Protection

If you lose access to your cryptocurrency wallets (for example, forgetting your passkeys or becoming a victim of a hacking incident), it can be impossible to retrieve your investments. With the lack of a centralized authority or insurance protection, such losses are typically permanent, unlike traditional banking systems, where there are usually safeguards for lost or stolen funds.

Understanding these pros and cons is critical to navigating the cryptocurrency landscape, particularly in preventing oneself from falling victim to cryptocurrency scams, a phenomenon that continues to beset this digital frontier.

Top Cryptocurrency Scams

Cryptocurrency scams have become increasingly prevalent, targeting individuals from all walks of life. However, one group that requires particular attention and protection is seniors, who may be more vulnerable to the deceptive tactics employed by scammers. They are often targeted for their potential lack of familiarity with emerging technologies and become prime targets for these scams.

What Seniors Should Watch Out For

As cryptocurrencies become more mainstream, it is crucial to address the risks seniors face, who may possess significant savings and a greater tendency to trust others.

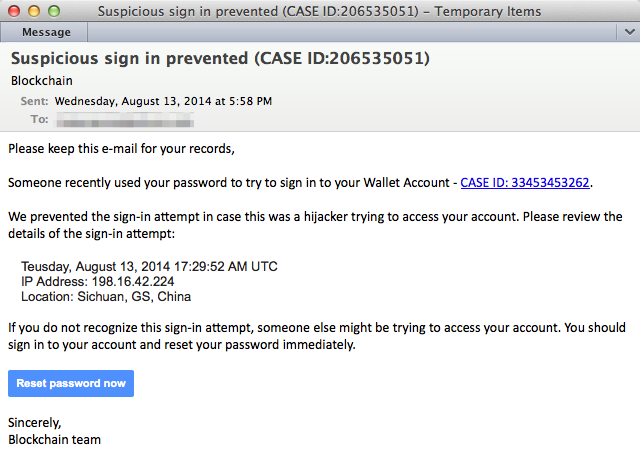

- Phishing Scams

Phishing scams involve scammers attempting to acquire sensitive information such as passwords or private keys by impersonating legitimate entities through emails, messages, or fake websites. Seniors should be cautious of unsolicited communications and avoid providing personal details or accessing cryptocurrency wallets through suspicious links.

- Fake Exchanges and Wallets

Scammers create counterfeit cryptocurrency exchanges or wallets that closely resemble legitimate platforms. Seniors should exercise caution when selecting an exchange or wallet provider, ensuring they use reputable and verified platforms to safeguard their funds.

- Pump and Dump Schemes

Pump and dump schemes involve inflating the price of a cryptocurrency through coordinated buying, then selling the holdings to unsuspecting investors. Seniors should be aware of investment opportunities that promise quick and guaranteed returns, as they may be lured into these schemes.

- Ponzi and Pyramid Schemes

Ponzi and pyramid schemes entice investors with promises of high returns and rely on recruiting new participants to sustain the scheme. Seniors should be wary of investment opportunities that offer unrealistic returns and heavily rely on recruiting others.

- Initial Coin Offering (ICO) Scams

ICO scams involve fraudulent fundraising campaigns where scammers offer new cryptocurrencies or tokens to investors. Seniors should exercise caution when investing in ICOs, conducting thorough research and verifying the project’s and its team’s legitimacy before contributing funds.

Preventive Measures Against Cryptocurrency Scams

Whether you are a seasoned investor or just starting to explore the realm of cryptocurrencies, safeguarding your digital assets and personal information should be a top priority. Here are some essential preventive measures you can take to mitigate the risks of cryptocurrency scams.

- Stay Informed and Educated

Conduct thorough research, stay updated on cryptocurrency scams, and educate yourself about blockchain technology and security practices.

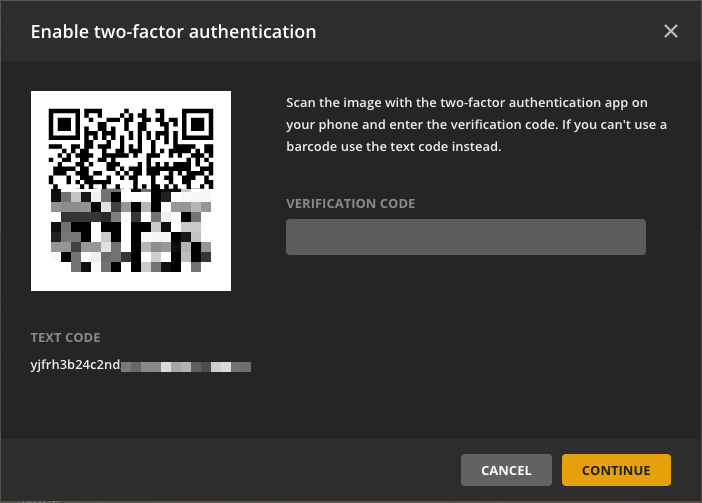

- Ensure the Security of Digital Assets

Use secure wallets, enable two-factor authentication (2FA), and safeguard your private keys.

- Exercise Caution in Online Interactions

Beware of phishing attempts, double-check website URLs, and be cautious of unsolicited investment opportunities.

- Seek Reliable Information and Support

Verify official channels, consult reputable financial professionals, and rely on verified sources of information.

- Use Trusted Exchanges and Platforms

Choose reputable and well-established cryptocurrency exchanges and platforms for your transactions and investments.

- Diversify Your Investments

Spread your investments across different cryptocurrencies and projects to reduce risk and avoid overexposure to scams.

- Trust Your Instincts and Practice Due Diligence

If an investment opportunity seems too good or raises red flags, trust your instincts and conduct thorough due diligence before making any commitments or investments.

- Regularly Update and Secure Your Devices

Keep your computer, smartphone, and other devices updated with the latest security patches and software updates. Use strong, unique passwords for your accounts, and consider using reputable antivirus software to protect against malware and phishing attempts.

Staying One Step Ahead

In the dynamic world of cryptocurrencies, vigilance and education are paramount. Scammers are continually devising new tactics to exploit unsuspecting individuals, making it crucial to stay informed and cautious.

As the cryptocurrency landscape evolves, it is critical to remember that learning is a continuous process. Stay engaged with reputable sources of information, follow industry developments, and participate in online communities to gain insights and share knowledge. Continuously learning about emerging trends and threats can adapt to the ever-changing cryptocurrency environment and make informed decisions to protect ourselves from scams.